All right, thank you Dan. Good morning everyone. Thank you for your patience. We appreciate you being here. We believe that the things we've put together will really be of value as you're starting your business or bringing new people into the expose II Azzam. - The feeling that people experience when they start is wonderful, but they need the structure to help them maintain it. - My story is that when I first learned about prior 9 plus, I had a family history of heart disease and I was determined not to have a personal history of heart disease. - So, when a doctor told me about prior 9 plus, I was very excited. I went to my first meeting, signed up, and was sponsored. I was ready to go. I had people that I wanted to share it with, and I started talking to them. - Suddenly, it occurred to me, "Oh no, what if they say yes? I don't have a clue where to find that form. I filled one out, but I don't know where it is, what information I need, what the prices are, or what product pack options are available to them." - It was almost like a hope and fear situation. I hope they say yes, but I hope they say no because I feel totally unprepared. - We want to help you avoid that situation for yourself and your new distributors. Today, we're going to talk a little bit about the how, the what, the where, and the when. - To get started, there are a couple of basic things you need to know. You need to know how to enroll new distributors and preferred customers. You need to know how to set up your auto-ship, how to set up your direct deposit,...

Award-winning PDF software

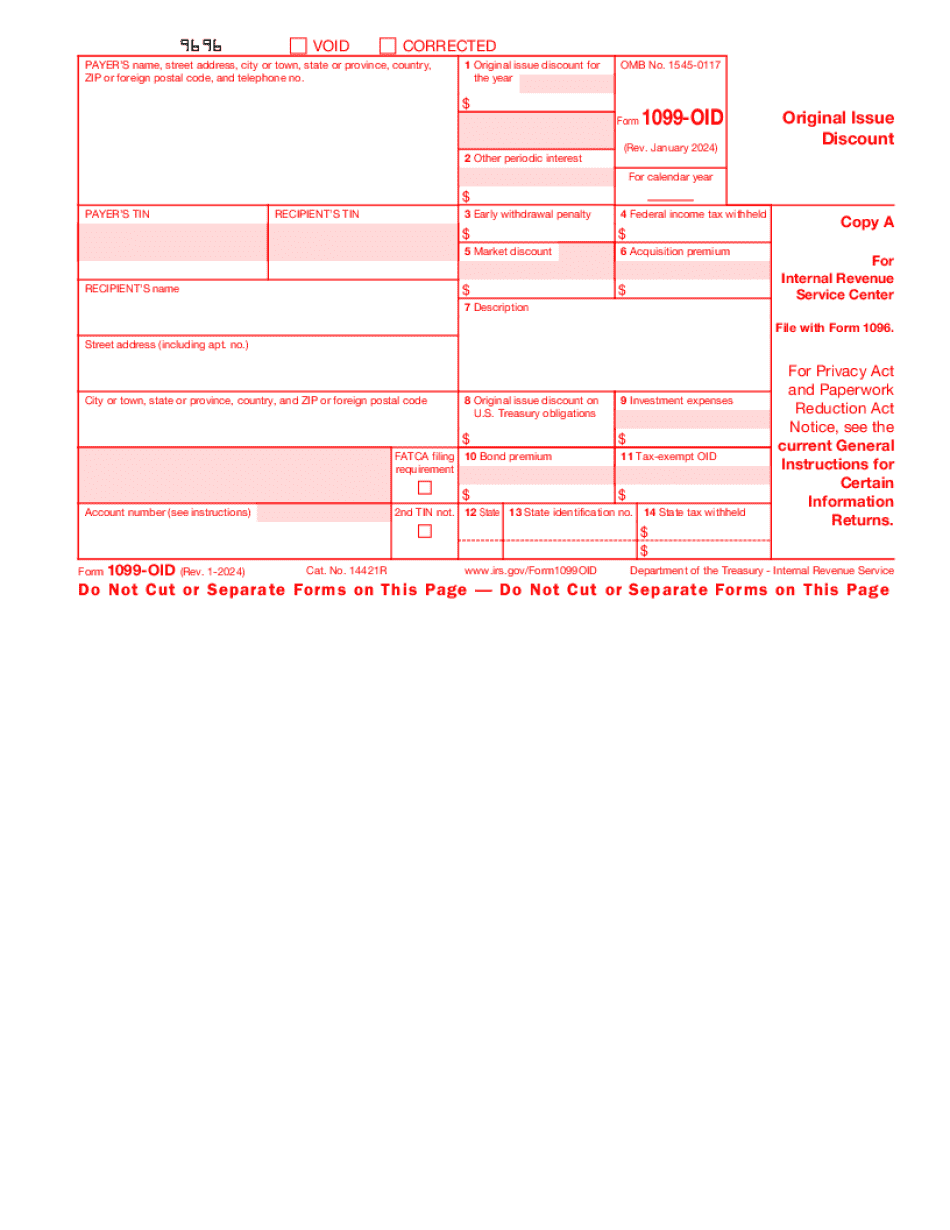

What is 1099-Oid Form: What You Should Know

In some cases, this may be because it is an investment. For bonds and the other securities where an “issuer” is involved (collectible bonds, certificates of deposit and other investments), CAN is required because of special provisions in securities laws that can limit eligibility for the tax. A bond (or note) issued by a company and bought by the issuing company (or a broker) are considered part of the issuer, and CAN is in effect as required by law. However, for bonds and the other securities where an “issuer” is not involved (investment bonds, certificates of deposit and any other securities where the “issuer” is a third party (such as a trustee or custodian of the security), CAN is not effective without specific authorization from the issuing company. (Read more about CAN.) The CAN rule does not apply for securities sold after a particular date. A security sold on a date that is after the date on which the original issue discount is charged against the security becomes taxable in its original issue discount rate. A bond or note issued after May 15, 1996, does not pay interest on the original issue discount — it is not considered a taxable security for CAN purpose—because the bond or note is eligible for CAN only if it is treated as an investment (see “Taxable investment bonds” below). What is a dividend? A dividend is paid as cash (or a portion of cash) from the earnings of a company. It is considered income to a shareholder if it arises on the sale or exchange of the company's stock or, in certain circumstances, income if it arose on the company's liquidation. A dividend is considered a debt interest even if the taxpayer holds the stock of the corporation in the same individual account as the dividend. A dividend paid on a stock that has been sold is usually shown on the investor's tax return of income. In other words, the stock is considered to be sold, even though the dividend received is shown as a cash gift from the shareholder to the company. A dividend received from stocks issued by a mutual fund, in return for a subscription to the fund's stock, might be taxable in the year in which it is received and any previous years.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-OID, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-OID online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-OID by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-OID from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is Form 1099-OID