Award-winning PDF software

How to prepare Form 1099-OID

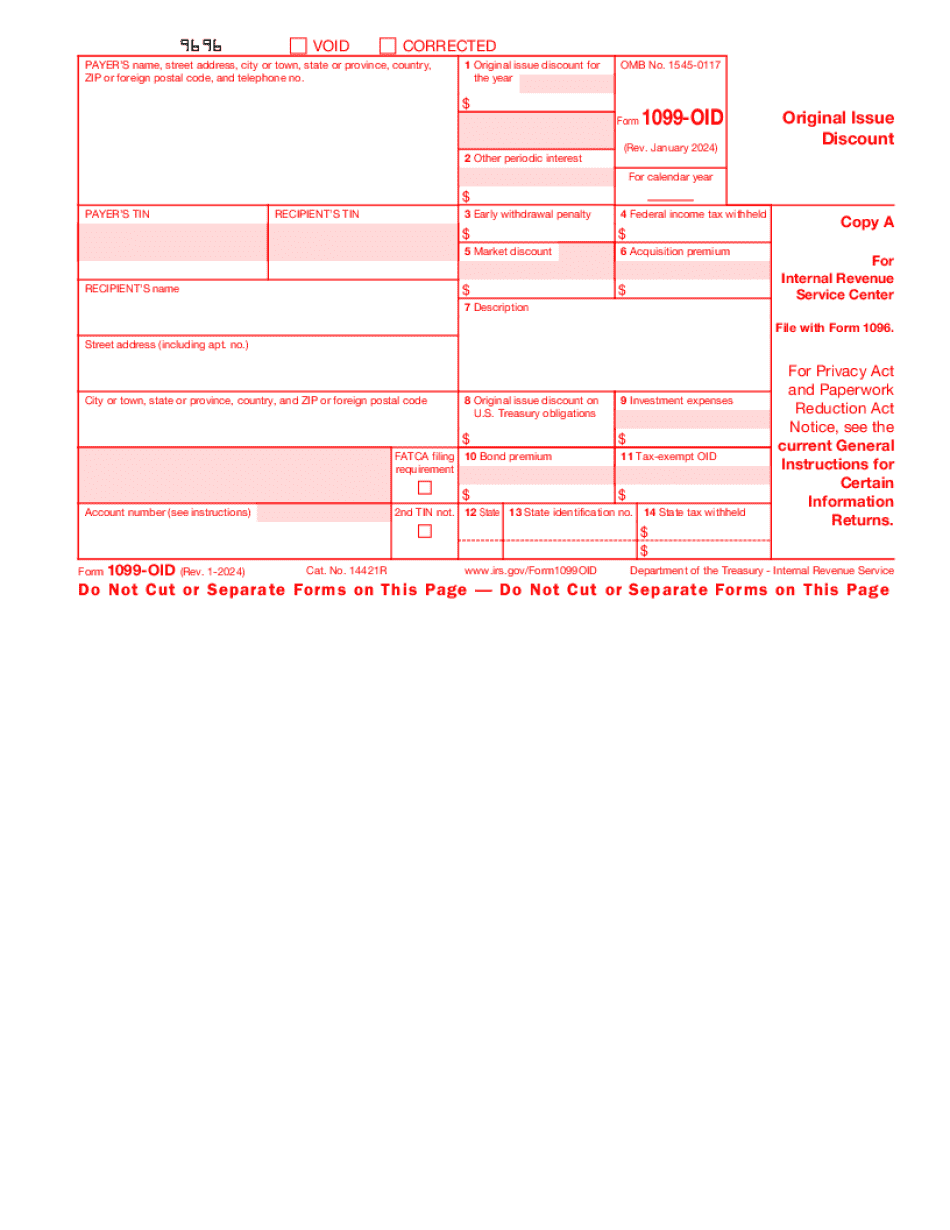

About Form 1099-OID

Form 1099-OID, also known as the Original Issue Discount, is a tax form used to report the difference between the stated redemption price at maturity and the issue price of a bond or other debt instrument. This difference represents the amount of interest that has accrued on the bond over time. The Form 1099-OID must be issued by the issuer of the debt instrument to the holder of the bond. The holder of the bond must report the OID as interest income on their tax return. It is typically used by investors or individuals who receive interest income from debt instruments such as bonds, notes, or certificates of deposit.

What Is 1099 Oid 2019?

Online technologies allow you to arrange your file administration and boost the productivity of the workflow. Follow the short information as a way to fill out IRS 1099 did 2019, stay clear of mistakes and furnish it in a timely way:

How to fill out a did form 1099?

-

On the website with the blank, click Start Now and pass for the editor.

-

Use the clues to complete the appropriate fields.

-

Include your individual data and contact data.

-

Make certain that you choose to enter true data and numbers in appropriate fields.

-

Carefully verify the content of your blank as well as grammar and spelling.

-

Refer to Help section should you have any issues or contact our Support staff.

-

Put an electronic signature on your 1099 did 2025 printable with the assistance of Sign Tool.

-

Once document is completed, click Done.

-

Distribute the ready document by way of electronic mail or fax, print it out or download on your gadget.

PDF editor will allow you to make changes to the 1099 did 2025 Fill Online from any internet connected device, personalize it in keeping with your requirements, sign it electronically and distribute in several means.