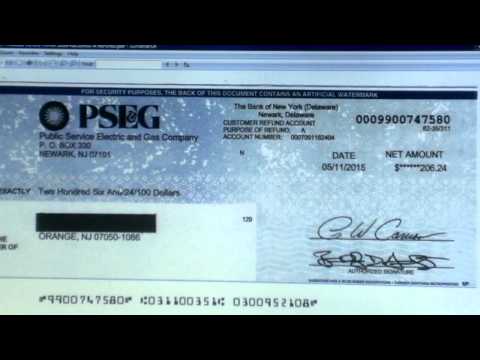

Hello, ladies and gentlemen. This is Morris Sadiq back once again with a video. Today, I want to teach you how to pay your PSE&G and utility bills with your credit trust account using your legal fiction account. Yes, it's the name in all caps that you may possess, which is your legal Nexus. Many people have attempted to do this, but unfortunately, they have failed because they are doing it wrong. So, I'm here to show you the proper way to get your bills, such as your PSE&G bill, utility bills, cell phone bills, and water bill, offset and paid. There is a correct way to do it. But first, let me show you this bill right here. As you can see, the bill amount is $206.24. And, if you look closely, you can see a credit balance after it was paid. The "CR" stands for credit. Usually, your PSE&G bill won't show the "CR" until you file the necessary paperwork. You need to file with PSE&G or any other place that is billing you in the legal fiction name. The bill I'm showing you here belongs to my wife, but her name is not visible in the image. Moving on, I have filed the required documents to PSE&G and two other places, and you can see where they credited the entire $206.24. The "CR" now stands for corrected credit. Now, let's look at the next bill, which is on the same account but for a different month. The bill amount is $179.62, and I have filed the necessary paperwork for both months. You can see here that they also sent the bill back stamped with a credit "CR" of $179.62. Some of you might think that this is not real, but I assure you it is very real....

Award-winning PDF software

Who needs 1099-Oid Form: What You Should Know

Form 1099-OID: Interest Paid, Form 1099-OID, and Form W-3 Form 1099-OID: Interest On Bonds That Pay No Interest The form 1099-OID is not available if interest you paid on a bond is less than 2.50, or the bond issuer only makes payments up to the amount you can redeem. Form 1099-OID: Interest Received, Form 1099-OID, and Form W-3 Interest Received on your bond, interest received from a loan or installment sale, or other interest you paid while the bond was issued, can be reported to you as interest. Interest received — interest that was reported but not received — can help pay off interest you owe (and reduce the basis and tax on your interest payments). Interest that was reported because it was not paid at all can reduce your tax, generally on interest and dividends paid during your holding period. Interest received does not qualify for filing as a Form 1099 if it has been reported because you paid it because you received any other tax. Form 1099-OID — Interest Received, Form 1099-OID Interest Received, Interest Received From Loan or installment sale Interest and other payments paid on a loan or installment sale, such as interest and dividends on a short-term secured loan or cash, can be reported under Form 1099-Q, interest income, rather than as interest from a discount bond on which you were paid.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-OID, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-OID online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-OID by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-OID from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Who needs Form 1099-OID