This text should be divided into sentences and mistakes should be corrected: - This creditors in commerce classroom session, here and after session, is the private exchange of ideas and concepts between the providers and the recipients. The content is not meant as legal advice. The use or attempted use of any idea or procedure discussed in this session as applied to the recipients' own personal transactions, cases, or controversies, or applied to other cases, may or may not result in a favorable outcome or the same outcome as discussed in this session. - Each transition or transaction case or controversy may be different as a result of unique actions or unique statements made by the parties therein, and each different act or statement in any transaction affects or may affect whether any procedure or idea discussed in this session is relevant to your transaction or that the outcome thereof will be depicted as in this session. - The discussion of ideas or procedures in this session is not exhaustive of the subject being discussed. Many ideas and concepts that can affect the outcome of any legal or commercial procedure are not discussed in this session, and the fact that you may not be aware of these issues may have an adverse effect on the outcome of your procedure. - It is the responsibility of each party to understand his own transactions and to apply the appropriate and complete concepts necessary for a procedural and substantive remedy thereto. - This session may be redistributed privately by any recipient to another recipient, requesting them, conditioned upon the fact that this notice is provided therewith. - If you have any questions, you may contact Brandon by email at harmony@creditorsincommerce.com or by telephone at 702-866-9077. - Well, I'm going to turn it over to Brandon here, so if you'd like...

Award-winning PDF software

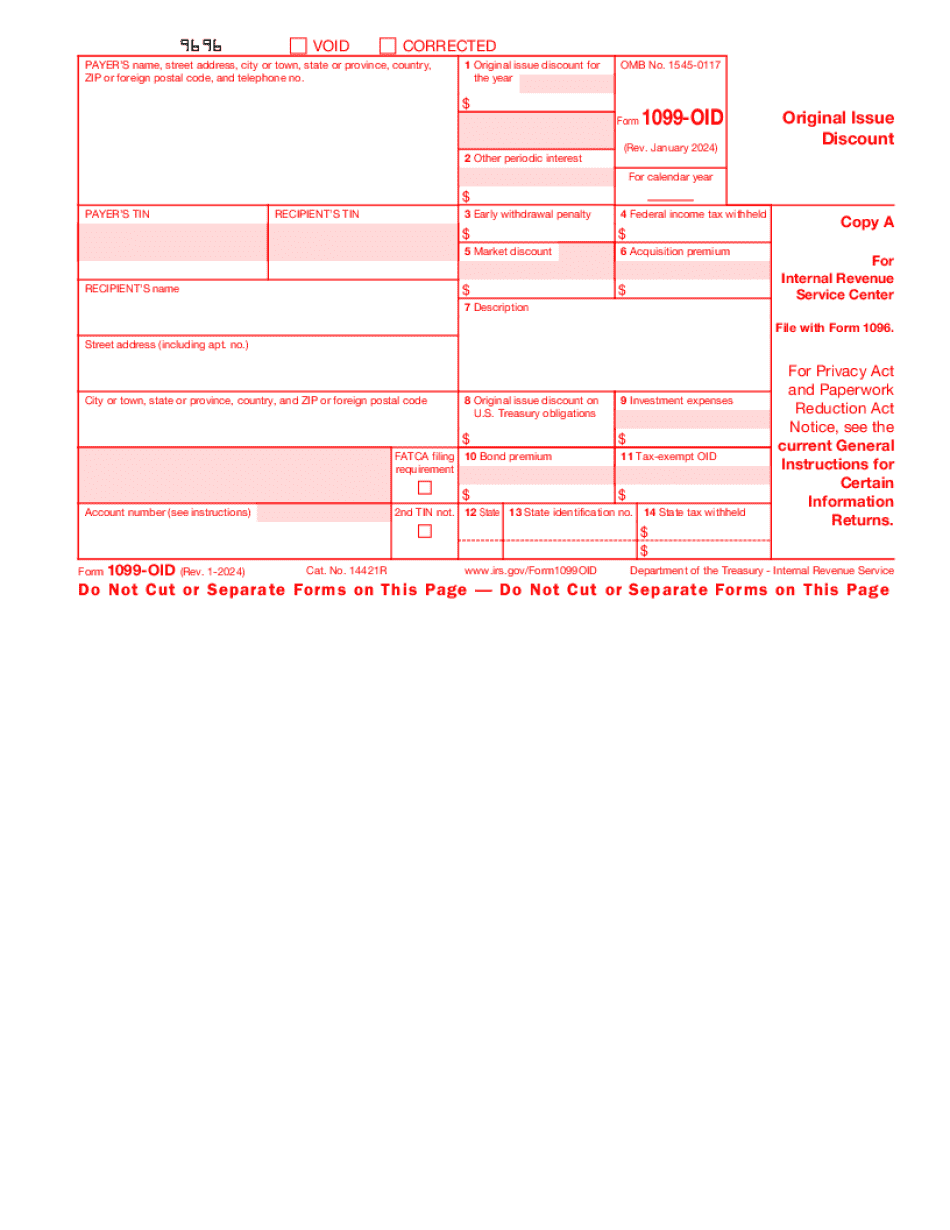

1099 Oid workshop Form: What You Should Know

However, if an individual dies, the sale would not be a taxable event. (See IRS Publication 17) If the instrument has a principal amount (i.e., amount you pay) of 10,000 or more, but only one sale at an amount of 10 or more made during a year, you report the income as 1099-B. Note that the sale has to be made during the tax year to be considered a taxable sale. Form 1099-B is used to report a principal amount less than 10,000 IRS Form 1099-B — Gross Income IRS Form 1099-B — Gross Income — Special Rules Note that an individual's gross income is reported on his or her personal tax return. If an individual dies, the sale would not be a taxable event. IRS Form 1099-B — Gross Income IRS Form 1099-B — Gross Income Form 1099-D is used to report sales of securities, options on securities, futures contracts, or similar instruments if the gross proceeds are over 10. Note that the sales are covered by the federal excise tax provision. The Form 1099-D Form is used as an alternative to Form 2555 or Form 3823. IRS Form 1099-D — Gross Income Form 1099-K is used by a nonresident alien individual to report the payer's gross foreign source income, provided that it is reported on the payer's tax return. For more information, see page 28 in Publication 519. Form 1099-K — Gross Income IRS Form 1099-K — Gross Income — Special Rules Form 9044 — Payments of Foreign Gift, Endowment, Donation, or Reimbursement Individual taxpayers may have to make payments to a foreign financial institution to secure an exemption. The Form 9044 and Notice of Withholding (Form 8859) must be filed with the IRS. (IRS.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-OID, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-OID online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-OID by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-OID from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099 Oid workshop