This is Simon from RideShare Dashboard. Today, I'm going to show you how to file your taxes with TurboTax online for your income from Uber, Lyft, and delivery services such as Postmates and Instacart. To begin, go to turbotax.com and sign up for a free online account. Once you log into your account, you will be presented with various options. Choose the option that applies to you. If you paid rent, select that option. If you have a W-2, the version you need is the self-employed version, which allows you to enter your business income and expenses. It will also fill out your Schedule C for you, which you'll need to file with the IRS. This is the only version you can use, and it is the most expensive option. Next, create a profile. For this tax return, I will be doing it for a single person without dependents, a home, or rent payments. TurboTax asks these questions because they relate to specific areas of the tax return. It tends to ask a lot of questions, so I will skip any other types of income and focus on the self-employed income, particularly from Lyft and Uber. You may notice that the last screen did not have a choice for self-employed income. This is because TurboTax assumes that, since you selected the self-employed version, you have self-employed income. It may seem strange, but it is intentional. I recommend having all the necessary paperwork with you before starting the process. It can be frustrating to go through the entire process and then realize you need to enter additional income. Wait until you have all your W-2s or 1099s before proceeding. Also, prepare your mileage records, not necessarily for submission, but to have an accurate number for later steps. Additionally, gather all your...

Award-winning PDF software

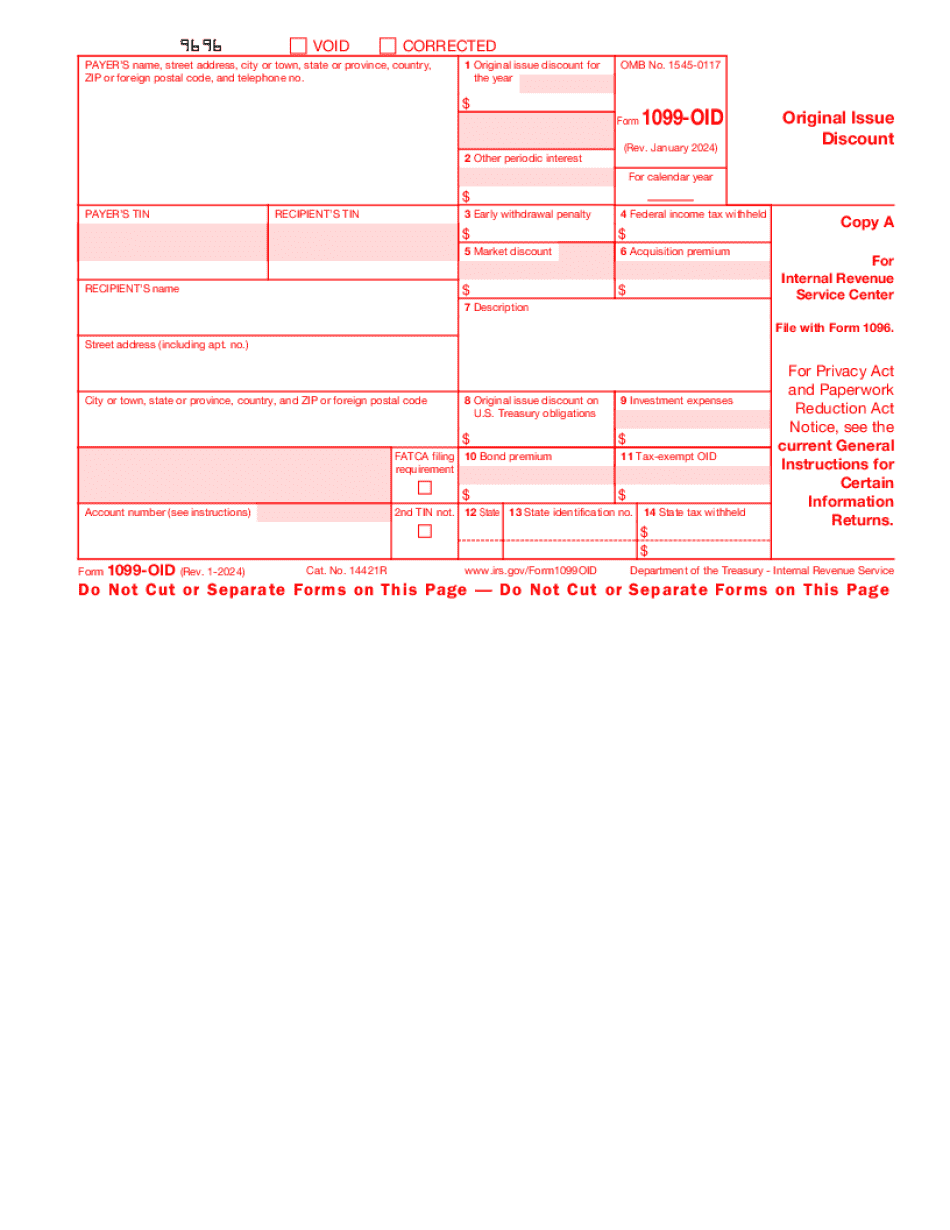

TurboTax 1099 Oid Form: What You Should Know

For example, dividends from a taxable mutual fund. Do not report dividends in box 15. Do not enter the interest for a self-employed person in box 11 and then in box 15. The person is considered to have taxable income as soon as they receive interest If a person receives interest income — in box 11 of the Forms 1099-OID they are considered to have taxable income as soon as it is received. Tax-free interest income from pension accounts — not the 1099-OID. In your federal income tax return, you should report all of your income as an entire dollar amount and no deductions are required when reporting your entire salary on Schedule A and any taxable interest payments you are making to your employer. This is your regular line, not the tax line. Your regular income tax line shows taxable income. This is not the line for interest payments you make to your employer. You are a self-employed person. You report your earnings from self-employment on your personal tax return. If you are a self-employed person, you must file an individual tax return. You do not need to file a joint return. Interest is not taxable. In most cases, it will be reported on line 10 of Form 1040, Line 15 of Form 1040A, and on line 22 of Form 1040EZ. (See Instructions for Forms 1040.) An employer who pays the employee a salary in excess of the amount that is subject to Medicare tax by law at your tax filing location should report the entire amount of salary in taxable income on your schedule A. Interest is not tax-exempt from the Federal tax; however, it is exempt from income tax. The interest is taxable if (1) the amount of interest paid is 10,000 or more; or(2) the interest is received after December 31, 2017. How Do I Report Interest Income Tax-Free? The interest income tax-free, if you are self-employed or an employee of an employer, is reported on Schedule A with a capital I. You should also list interest income received from a pension or other retirement plan. The amount of interest paid is taxable if it is 10,000 or more. If you don't report income to the capital I on line 3 or 7 of Schedule A, then you are not required to submit Form 1099-OID.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-OID, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-OID online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-OID by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-OID from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing TurboTax 1099 Oid