Weiss & Associates presents the short sale seller an unrealized lifetime benefit of this real estate process. There are many professional real estate brokers who offer specialized services in helping homeowners with the short sale process. Americans have heard of the cyclical nature of the property values that occur across the 50 states of the union. People find themselves upside down financially at times, and vigorous solutions are needed to help resolve this distress on any family. In researching this subject, we came across a firm by the name of the Napoli Group and their website, thenapoligroup.com. They have a short discussion on the aspects of the short sale process and mention many factors of benefit to the homeowner who's having financial difficulty and it impacts their current home. It's well presented and informative, but we have no association with them. Weiss & Associates has viewed a number of real estate professionals' YouTube videos on this subject, but we particularly like the Napoli presentation explaining the short sale similar benefits when they're faced with the current financial situation. The end of the transaction shows that the seller is able to unload the property to avoid bankruptcy as the bank lowers the mortgage amount in order to avoid the headaches they have in dealing with foreclosed property. We will not go into all of these professional real estate agents discuss, but we did come across something that was omitted by virtually all the videos we reviewed on the short sale process in regard to the seller. The issue is the gap between what the seller had as a mortgage amount on the original loan and the new amount for the transaction made by the new buyer. The easiest way to express this difference is by the term mortgage gap. At the end of...

Award-winning PDF software

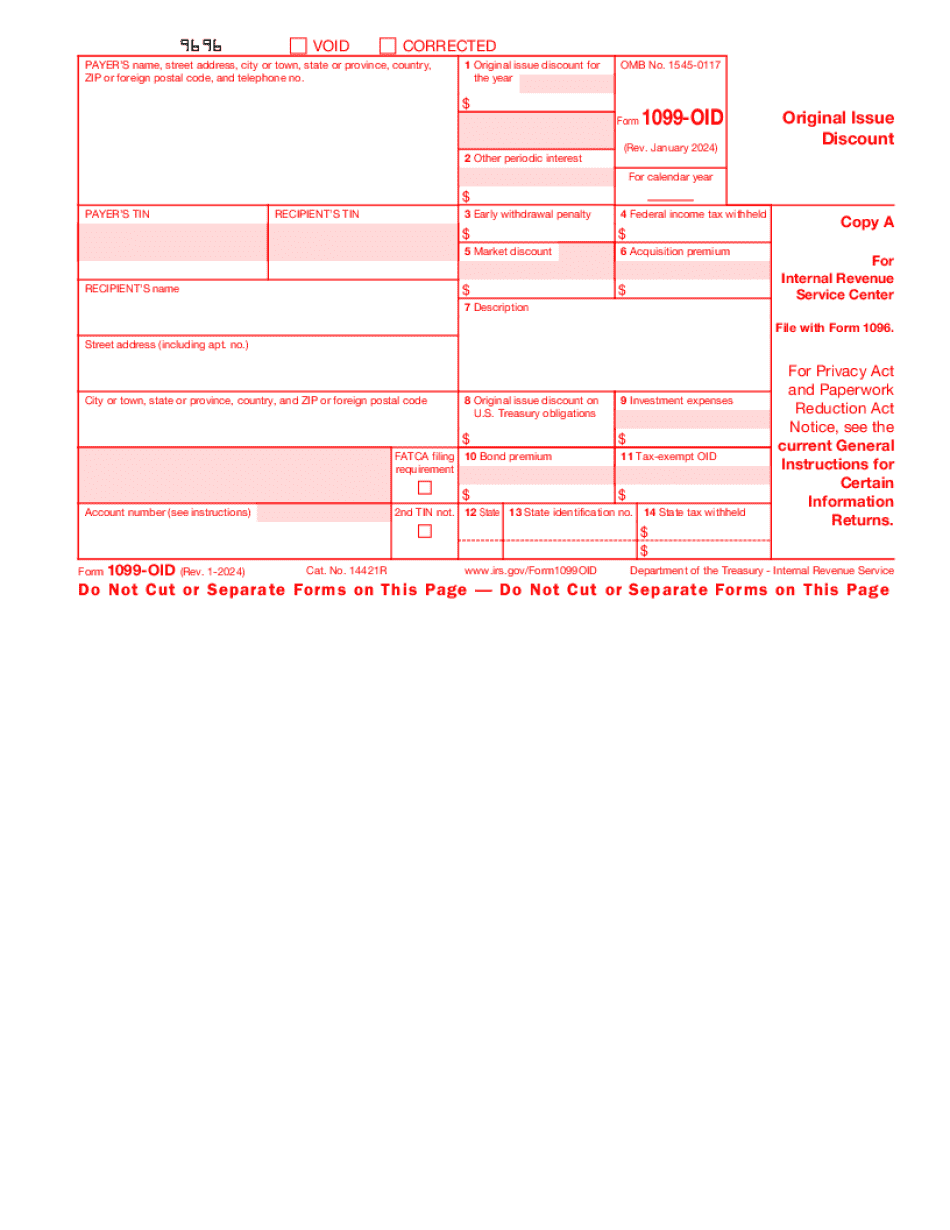

How to report oid on tax exempt bonds Form: What You Should Know

There are exceptions to this rule. Exceptions to reporting DID and IRS Form 1099-OID May 31, 2025 — Reporting tax-exempt interest on taxable bonded debt is generally required as described in Revenue Procedure 2012‑27, October 21, 2012, §8(a)(1) — Interest payment is generally recorded in the hands of the mayor and any interest tax withheld, or credited to the mayor's federal income tax return, on Form 1041. Interest paid in the form of a note is reported on Form 1099‑INT. Exceptions to reporting interest paid, and Form 1099-OID Sep 29, 2025 — Exclusion of Interest Paid on A.I.D. Bonds is not required. Interest paid on A.I.D. Bonds is not reported on Form 1099-INT. Interest paid by a nonresident alien is subject to the EAR. Exceptions to reporting interest on the A.I.D. bond Sep 19, 2025 — Exclusion of Interest Payments on Tax-Exempt Bonds is not required, but the tax-exempt bondholder must report the payment on Form 1099-T Sep 24, 2025 — Exclusion of Interest Payments on A.I.D. Bonds is not required, but the mayor must report the payment on Form 1099-T Apr 25, 2025 — Exclusion of Interest Payments on Tax-Exempt Bonds is not required, but the holder (i.e. the holder of the bond) must report the payment on Form 1099-T See also: Form 1099 Instructions For a specified private activity bond with DID, report the tax-exempt DID in box 11 on Form 1099-OID, and the tax-exempt stated interest in boxes 8 and 9 on Form 1099-INT. Exceptions to reporting. No Form 1099-OID must be filed for payments made to exempt recipients or for interest excluded from reporting. However, a tax-exempt bond that is issued on a corporate basis (not by individual investors acting as representatives of corporations) and is not subject to the registration provisions of Internal Revenue Code section 1213 (see Pub. 3 and Pub. 55), is subject to the exclusion rules for foreign branches of U.S. incorporated private activity bonds. See section 1213.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-OID, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-OID online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-OID by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-OID from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to report oid on tax exempt bonds