Okay class, I just did a video on the effective interest rate calculator. Use it as an example of a discount. Now, we're going to do the same thing, but in this case, it's going to be at a premium instead of a discount. Alright, so my example is going to be the same. We've got bonds worth $100,000 at this corporation that's going to be selling. These bonds are four-year bonds, and they're going to pay interest annually. The contract rate is 10 percent, which can also be called the coupon rate, stated rate, or nominal rate. I'm going to call it the contract rate because that's what my textbook uses. The market rate right now is 8 percent. When the contract rate is 10 percent, but a bond at this risk level would normally sell at 8 percent, then this bond is going to sell at a premium. It's going to sell above the $100,000. However, we're going to see that these investors are really only going to earn 8 percent, not 10 percent on these bonds. Let's do this timeline again and value what these bonds are going to sell for. First of all, we've got to look at the cash flows, which are the interest and what it's going to pay out at the end, the $100,000. The interest is calculated by taking the contract rate (also known as the coupon, stated, or nominal rate) of 10% and multiplying it by $100,000. So, the corporation will pay out $10,000 cash every year for four years. That's what my timeline is showing here (1 year, 2 years, 3 years or 4 years), and then it will also pay back the full bond amount of $100,000 at the end. So, this right here is my cash flow. Let's...

Award-winning PDF software

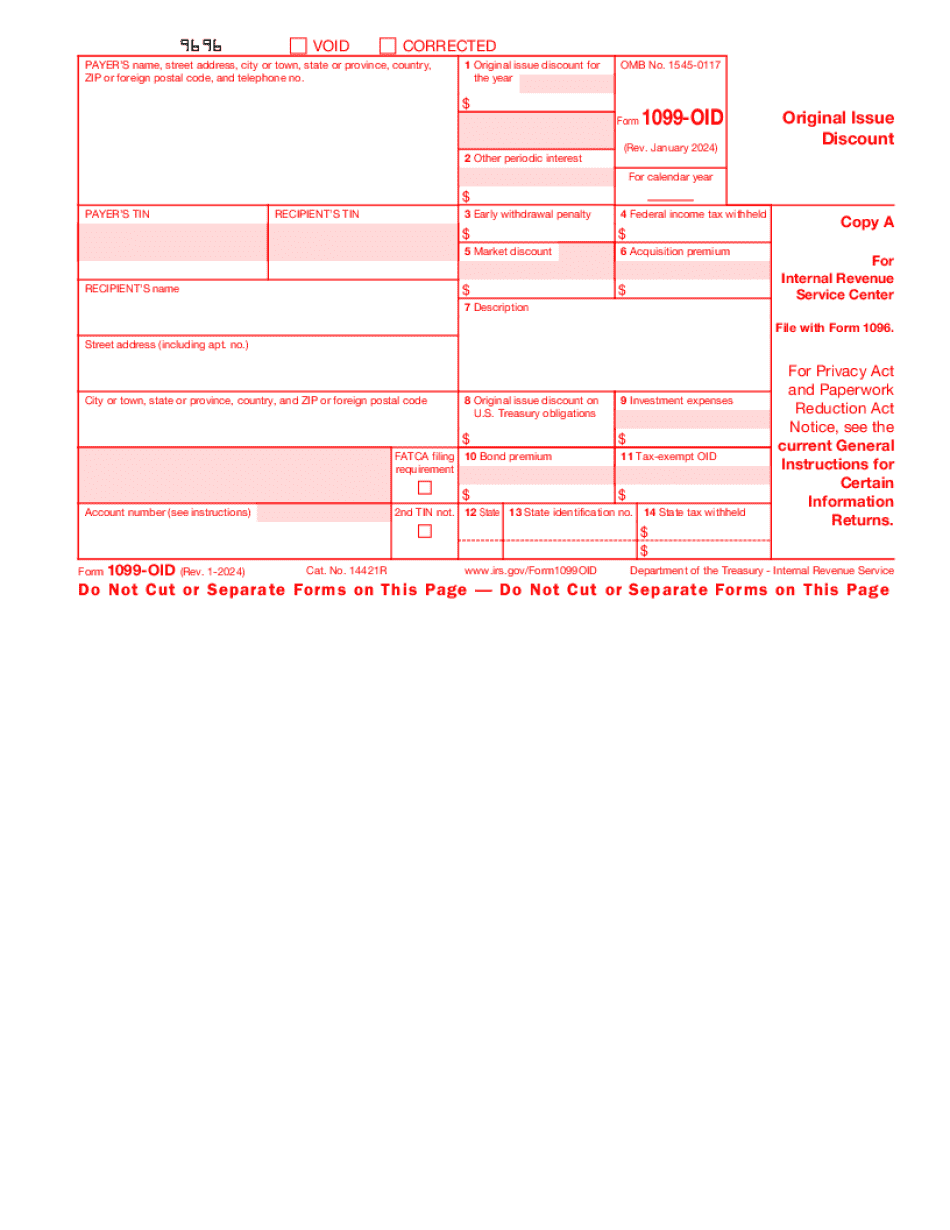

Acquisition premium amortization Form: What You Should Know

Form 1099-INT — Determining the Amount That is Excluded from a Form 1099 You must include all proceeds from the sale of a security with interest on it from a sales transaction, if (1) the sales transaction is qualified and (2) the proceeds from the sale of the security are not included in Form 1099-INT — Determining the Amount That is Excluded from a Form 1099 If the sale of the security is an eligible qualified sale under the tax law, and no proceeds from the sale of the security (determined on the basis that they were received by Form 1099-OID — OID-Related Amount (1) are included in the gross income of the taxpayer, and (2) under section 6045(a), were received or accrued in respect of an eligible covered security, then the amount from the sale of the security is excluded from gross income. Income that may be excluded from gross income includes, from a covered security (a) dividends of the taxpayer, or (b) income from a mutual fund interest, or (c) from other sources described in paragraphs (a), (b), and (c). The following is the definition of “covered security”: “Investment property” means any investment (as defined in section 1, qualified or otherwise) or fund (as defined in section 8(e), qualified or otherwise, or not-for-profit) that is held for its principal purpose of owning or holding property. “Qualified gross income” means gross income for purposes of chapter 31 that is (a) subject to section 1221, 1222, 1322, or 1323, and (b) the gross income of the covered security if it is determined by section 6212 using the original issue discount method. (a) Subject to section 1221, 1222, 1322, or [[Page 67183]] 1323. (b) Excluded income. Gross income does not include any amount that is described in paragraph (a) of this section if the amount is excluded from gross income that is subject to section 1221, 1222, 1322, or 1323. (1) An eligible qualified sale. This section applies if all requirements of section 6213 are met. (2) Capital gain and loss limitation.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-OID, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-OID online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-OID by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-OID from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Acquisition premium amortization