Hi this is Lee Kearney you can see exactly how I flipped 4250 house a month and do over 100 million dollars per year in real estate sales by clicking on the link below this video just fill out the short form and the next page to receive my groundbreaking course seven steps to flip your income and real estate worth three hundred bucks it's yours today absolutely free simply for watching this video GPM click the link below to get your free course and find out who you can learn my exact processes and business methods for scaling a multi-million dollar wholesale real estate business of your own click the link and fill out the form to get started if you're not running your business as a CEO and my multi-million dollar business even if you are one people team you need to come here and learn how to do it because if you don't you know what are you going to change our mentality you got to change my mentality from a business owner to see you my favorite part it's hard to say because I like every single part and again the team being in the office and watching the team atmosphere just all those bunch of rule 4 it's actually big parts and all of the people and they're working together and it's so smooth it is just mind boggling I can't get two people to work smoother than having 16 people then it's just mm mm and that was mind blowing I I think one of the biggest problems of my employees I don't think I gave them much directions and all the lists and the daily tasks and that's just wow I can totally see everything changing I think my foundation was on the...

Award-winning PDF software

Publication 550 Form: What You Should Know

It even helps you check the correct box on your IRS Publication 550 — TurboT ax Tax Tips & Videos — Intuit Sep 12, 2025 — In this edition of TurboT ax Tax Tips and Videos, you can learn how to file Form 941, the Individual Return of Income. TurboT ax Income Tax Calculator shows you all the numbers you need to know to figure out your IRS Publication 550 — TurboT ax Income Tax Calculator and TurboT ax Income Tax Tips & Videos — Intuit Oct 27, 2025 — In this edition of TurboT ax Income Tax Tips and Videos, you can learn how to file Form 949, the Annual Return of Income and Expense Report.

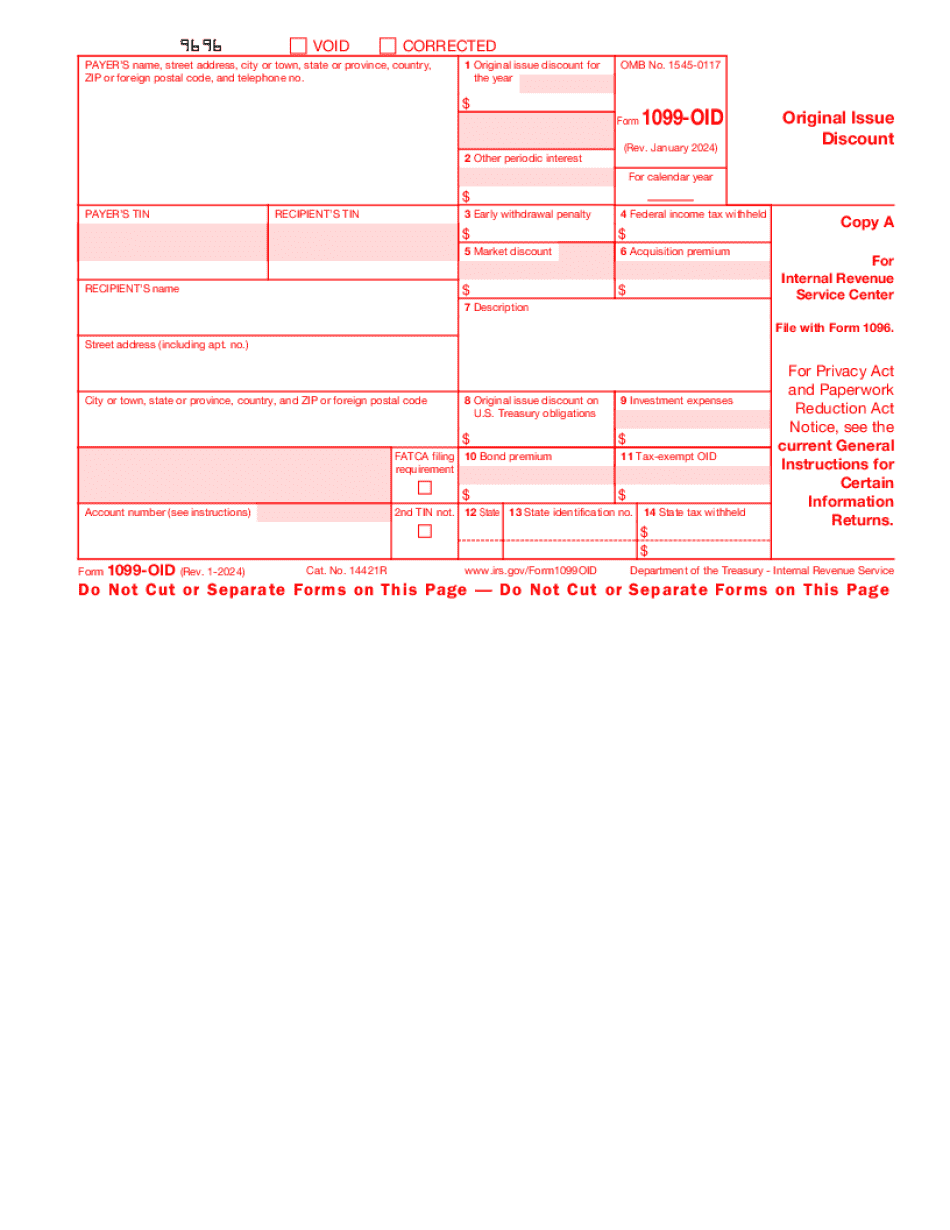

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-OID, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-OID online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-OID by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-OID from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Publication 550