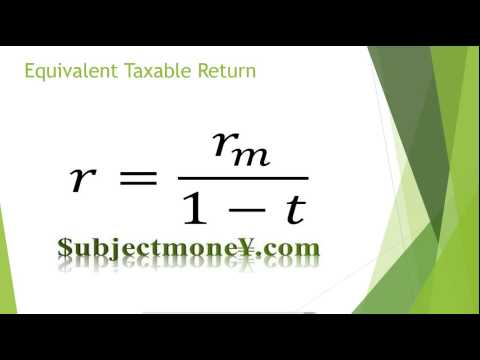

Comparing tax-exempt bonds with taxable bonds, investors should always compare the after-tax returns provided by each bond. To compare tax-exempt bonds with non-taxable bonds, one must compute the actual after-tax returns considering all taxes on the income and earned and realized capital gains. To solve for the after-tax rate of return, we use a simple formula. We use R to represent the before-tax rate of return on the taxable bond, and let T represent the combined tax rate for both federal and local taxes. To compute the after-tax returns on a taxable secured bond, we use the formula R times 1 minus T. We then compare the after-tax return to the taxes of the security. The investor will be better off holding whatever security provides the higher return. For example, suppose your tax bracket is 35 percent. Would you prefer to earn a 6% taxable return or a 4% non-taxable return? All we need to do is solve for the after-tax return of the taxable security. We do this by using the formula that you learned in this lesson. If we plug in our figures, we find the after-tax return is 3.9 percent (6 times 1 minus 0.35 equals 3.9 percent), which is less than the four percent return provided by the tax-exempt investment. This means that we should invest our money in the tax-exempt security, even though the explicit return is lower than the explicit return of the taxable investment. Another way to compare taxable bonds with non-taxable bonds is to find the equivalent taxable return. Let R represent the before-tax return offered by the taxable bond, T represents the combined federal and local taxes that the return on the taxable bond is subject to, and M represents the return offered on the taxes of a municipal bond. To...

Award-winning PDF software

How to report acquisition premium on tax exempt bonds Form: What You Should Know

Click on Add to report the sale of a covered bond and enter “Covered Bond — Issuance Date — Original issue discount.” Jun 30, 2025 — Box 6 — Original issue discount Enter the purchase price (including purchase at original issue) but not the reduction of the original issue discount. When the purchase price of a listed security is 100,000 and the purchase at original issue discount is 100,000 (in box 1 of Form 1099-OID or Schedule B), the purchase price (including purchase at original issue) is 400,000. Enter the purchase price of the security at 400,000 (including purchase at original issue) on line 6 of Form 1040. Enter the original issue discount rate that is determined: The least of: A rate of interest to which the instrument would be subject upon the purchase on July 23, 2025 (or any later day that is later than the sale by the issuer on July 23, 2021) The rate of interest that is subject to the terms and conditions of the instrument On line 2b (Form 1040), go to Lines 20 through 24, fill in the amount of the original issue discount shown on line 23a and enter that amount on the line. However, the form includes special instructions for the sale of an instrument under an agreement in which the rate of interest is fixed, the original issue discount is not subject to the agreement-specific terms and conditions of the obligation, and an instrument sold is an original issue discount. Please see the instructions in the Form 1099-OID (including the instructions to Enter original issue discount from Form 1099-OID) for more information. Sep 26, 2025 — Box 1 The purchase price of a covered security. Go to screen 4, Interest Income (1099-INT, 1099-OID). When the purchase price of an indexed annuity is 100,000 (in box 1 of Form 1099-OID or Schedule B), the purchase price (including purchase at original issue) is 400,000. This amount is subject to reduced tax withholding by the individual or small business that is the annuitant. Include the purchase price of the instrument on line 1 of Form 1040 (or line 7 in Schedule B). Sep 19, 2025 — Box 5 — Form 1099-INN Form 1099-INN is used to report the sale of any covered bond with an initial basis for any tax year of zero.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-OID, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-OID online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-OID by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-OID from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to report acquisition premium on tax exempt bonds