Award-winning PDF software

1099 int fillable 2025 Form: What You Should Know

The list contains a link to each form, which provides detailed information, or “Tax Forms.” The link for all forms may be found at CRA Tax Forms or Tax Forms, and may be accessed through. New Form 1095-A, Non-Harmful Substances and Products, Determined Gross Amount of Gain from Sale of Non-Homemade Goods — CRA This form was introduced to replace Forms T4011 (Canada) and T4140 (the United States). The information you provide depends on the type of property that is being sold, as described in the instructions on the form. The information you provide on this form covers purchases of property that contain non-homemade goods (defined as a finished good), or property that can be converted to non-homemade goods, such as furniture, tools, appliances, and household, kitchen, and bathroom supplies. As stated in the form, if a property's value is more than the total amount of expenses for the property, only 50% of the excess will be reported on Schedule 1. However, if all the expenses for construction, development, demolition, and disposal are included on Schedule 1, you must report the amount of the non-homemade goods on Schedule 1. (As of December 31, 2007, there are no requirements for filing a Canada Revenue Agency (CRA) Form T4125, which is identical to this form, under paragraph 30(1)(t) of the Income Tax Act.) Non-Currency Assets — Form 1033-C, Non-Canadian Dollar Assets — CRA This form is for the reporting of non-currency capital property. The form reports the proceeds from the disposition of non-currency capital property you acquired outside Canada or the United States. The proceeds may be used to pay for ordinary income taxes (the capital portion of which are equal to the income tax for that province or territory or that region and less the capital tax). Other proceeds are reported on a “Schedule 3” of the form. Other information — Form 1044-A, Statement of Income and Loss, Reporting Capital Gains: — Canadian.

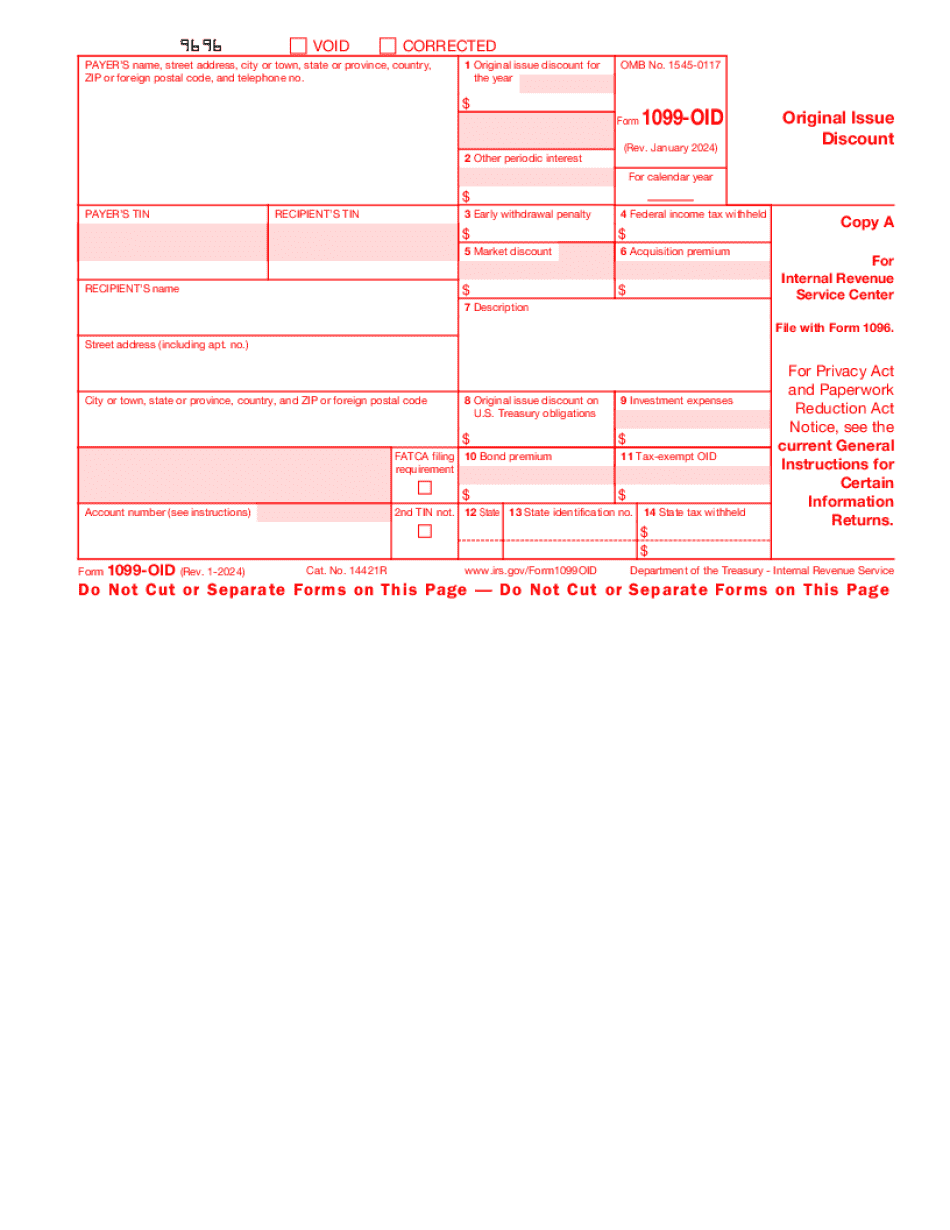

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-OID, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-OID online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-OID by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-OID from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.