Award-winning PDF software

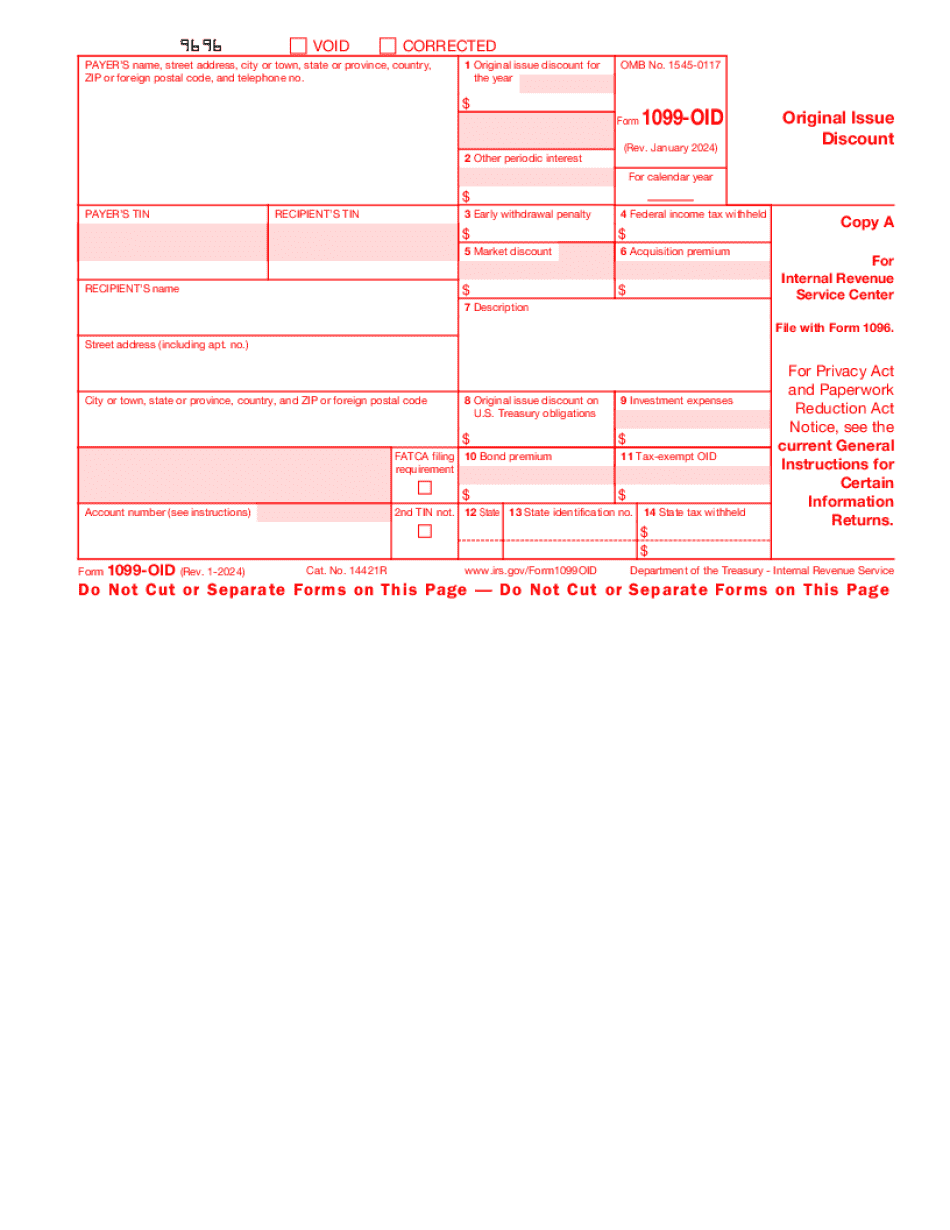

McAllen Texas Form 1099-OID: What You Should Know

The bonds don't pay interest and the bonds have zero market value. To apply this interest to the income to be reported in your income tax return for the year:1. Determine the fair market value of the bonds. The “fair market” is determined by: (1) the current market for bonds as determined by the Fitch Ratings or by the market price and yield on other bonds or bonds with similar characteristics and (2) the market value of bonds at the beginning of the reporting period in which the interest is paid. The fair Market Value of bonds paid at a discount are reported as fair market value bonds. (A bond that pays accrued interest is not considered to be treated as fair market.) If the fair market value of the bonds when they are issued is less than the value you can redeem for the bonds when they are paid (the current market value of your purchases), then you are due a Form 1099-OID. You must treat the bonds as acquisition income for purposes of figuring the amount of interest tax due on them.2. Subtract 2 per 100 of net acquisition cost from the fair market value of the bonds to determine adjusted cost basis. For more information on acquisition and amortization of debt securities, see chapter 2. For more specific guidance and examples, see Exhibit 2‑4 of Pub 15‑A .3. Subtract the 2 per 100 of net acquisition cost of the bonds from your purchase price, less allowable deductions. The excess gain from the redemption of the bonds is yours.4. Enter in box 14 the amount of the interest you are required to report in your income tax statement for the year. For most taxpayers, this amount is the fair market value on the date you received the bonds. To be sure, determine whether the fair market value is the amount at which the bond could have been purchased at market value.5. If the total amount realized is more than 3,000, or 3,000 multiplied by 10,000, a Form 1099-OID must be filed, even though you may have not realized a gain on the bonds.6.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete McAllen Texas Form 1099-OID, keep away from glitches and furnish it inside a timely method:

How to complete a McAllen Texas Form 1099-OID?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your McAllen Texas Form 1099-OID aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your McAllen Texas Form 1099-OID from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.