Award-winning PDF software

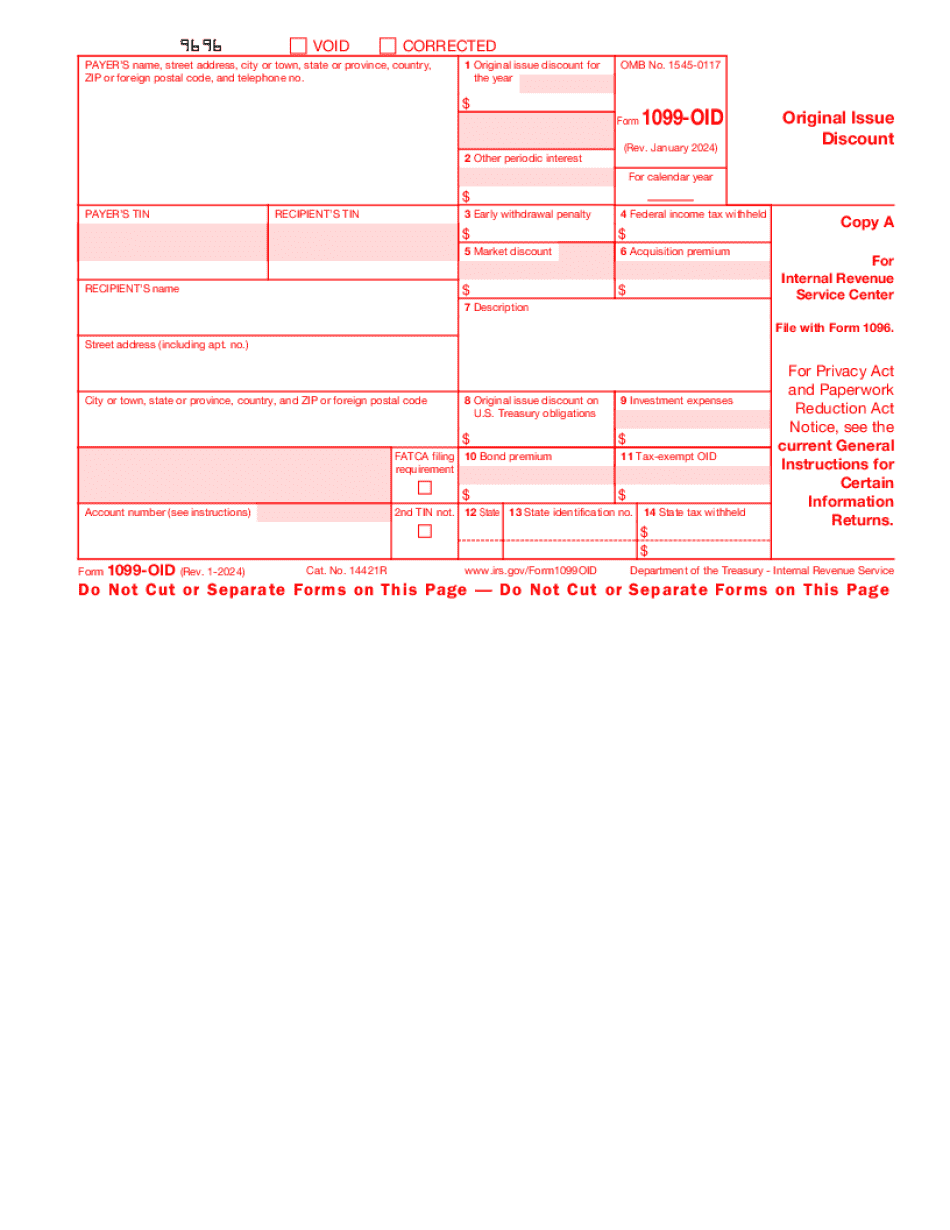

Salinas California Form 1099-OID: What You Should Know

Gov The information provided is intended to provide general information only. The information in this information circular may not be complete or current. IT IS IMPORTANT NOT TO USE THE INFORMATION CONTAINED FOR TAX PURPOSES OUTSIDE THE UNITED STATES. In the U.S., some information in this booklet is considered to be information subject to the provisions of section 2518 of title 28, Code of Federal Regulations (CFR) and should generally not be used to determine tax liability. In the U.S., taxpayers may use the information provided in this information circular to obtain copies of their W-2s and 990 forms from the IRS. Taxpayers may obtain a copy of their W-2 as required from their employer or from the IRS by calling + (toll-free). The IRS provides telephone services at rates no lower than the cost of local telephone service. In the U.S., the requirements under section 7512(c) of the Code of Federal Regulations are designed to protect against an excessive use of a non-social security number (SSN). To determine whether the information provided is sufficient for this purpose, the IRS requires that the taxpayer not use, for a period of more than six months after the last month for which the taxpayer actually furnished the information, more than one Social Security number. For more information, please visit IRS.gov or call the IRS at +. IRS.gov IRS.gov is now a comprehensive source of information and resources for both taxpayers and accountants. It provides the guidance to comply with all the tax laws, provides useful links to websites, provides links to publications and links to helpful information. All the information, guidance, and resources are organized in one site, so you can jump from one section to another easily. In the United States, you can request a paper tax return, the free e-file option for most individuals, and access taxpayer information by completing the Free File Challenge and entering in answers to the questions. The IRS offers guidance to help taxpayers complete the Free File Challenge and is available through the IRS.gov website. A tax preparation program may also be used for tax purposes.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Salinas California Form 1099-OID, keep away from glitches and furnish it inside a timely method:

How to complete a Salinas California Form 1099-OID?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Salinas California Form 1099-OID aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Salinas California Form 1099-OID from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.