Award-winning PDF software

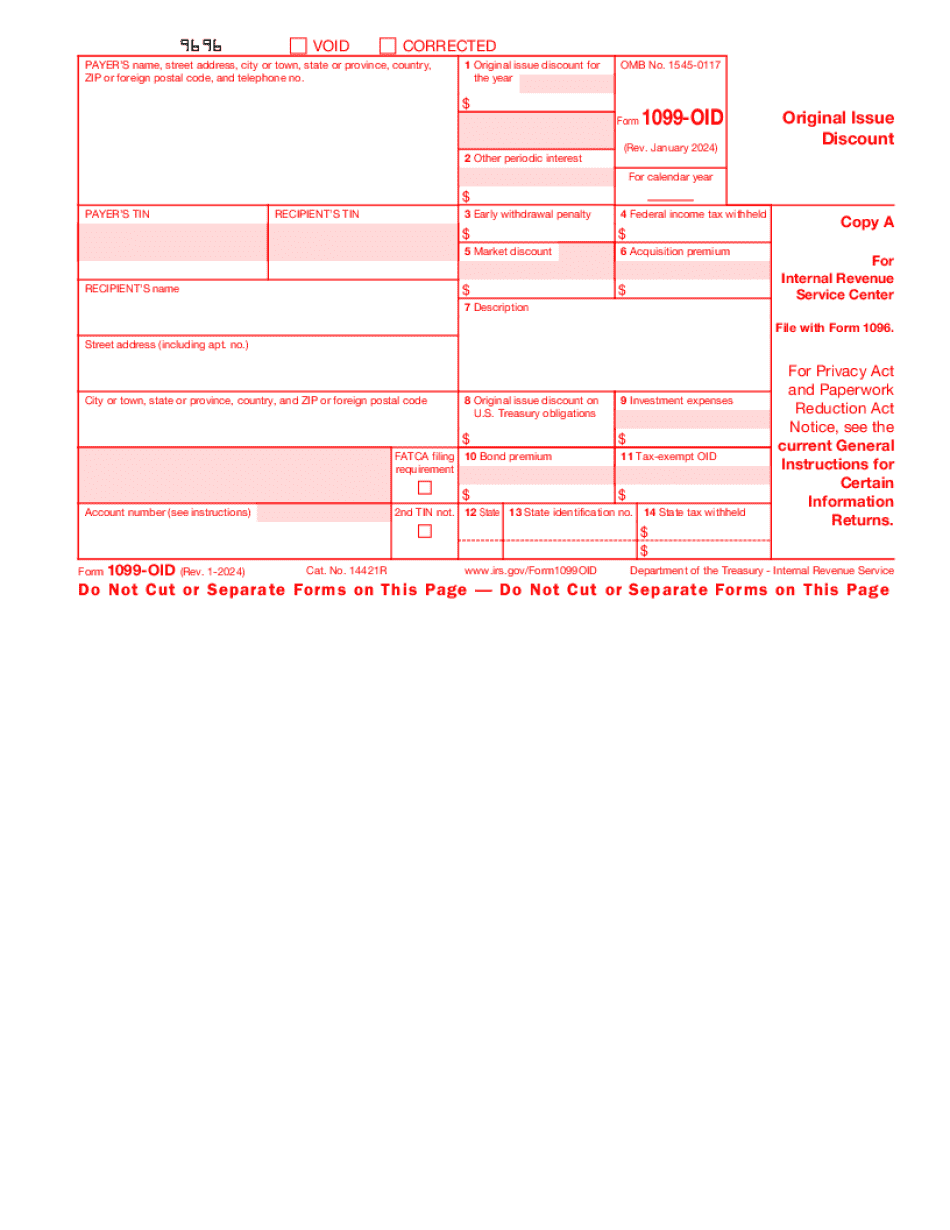

Form 1099-OID California San Bernardino: What You Should Know

Sep 30, 2025 — The Tax Foundation of America announces that the U.S. Department of Treasury has decided to phase out the use of 1099-MISC for non-retirement business income and will replace these forms on January 21, 2019, for all non-retirement business income (other than those related to the sale or exchange of businesses or the receipt of compensation for sale or exchange of businesses). The new forms to issue for business income (including commissions, stock options, etc.) will be 1099-C and will be available on electronic media such as email. Sep 30, 2025 — The IRS has announced its intent to phase out the use of 1099-MISC (Individuals) for all non-retirement income, including income related to the sale or exchange of businesses.[1] IRS will issue the new 1099-MISC forms (Individuals) for business income only beginning January 21, 2022. Taxpayers will have the ability to file Form 1099-MISC once a year on or after that date. FTC Issues Cease and Desist Letter To Business Websites With False Tax Return (FTC) Information Sep 29, 2025 — FTC issued cease and desist letter of enforcement to an organization for publishing false tax information; FTC seeks to cancel publication and impose a financial penalty. LAWYER ASSIGNED 1.4M TO FILING AND COMPLIANCE CENTERS TO SETTLE TAX RETURNS, CUSTOMER CRIMES Sep 27, 2025 – 1.4 million in restitution has been awarded by the U.S. Attorney's Office in the Northern District of California to settle charges that several large California filing and compliance centers received a substantial number of phone calls containing threatening and obscene telephone calls. The callers threatened to harm the victim's reputation and financial standing, and falsely claimed that the caller had filed a tax return (Form 8283).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-OID California San Bernardino, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-OID California San Bernardino?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-OID California San Bernardino aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-OID California San Bernardino from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.