Award-winning PDF software

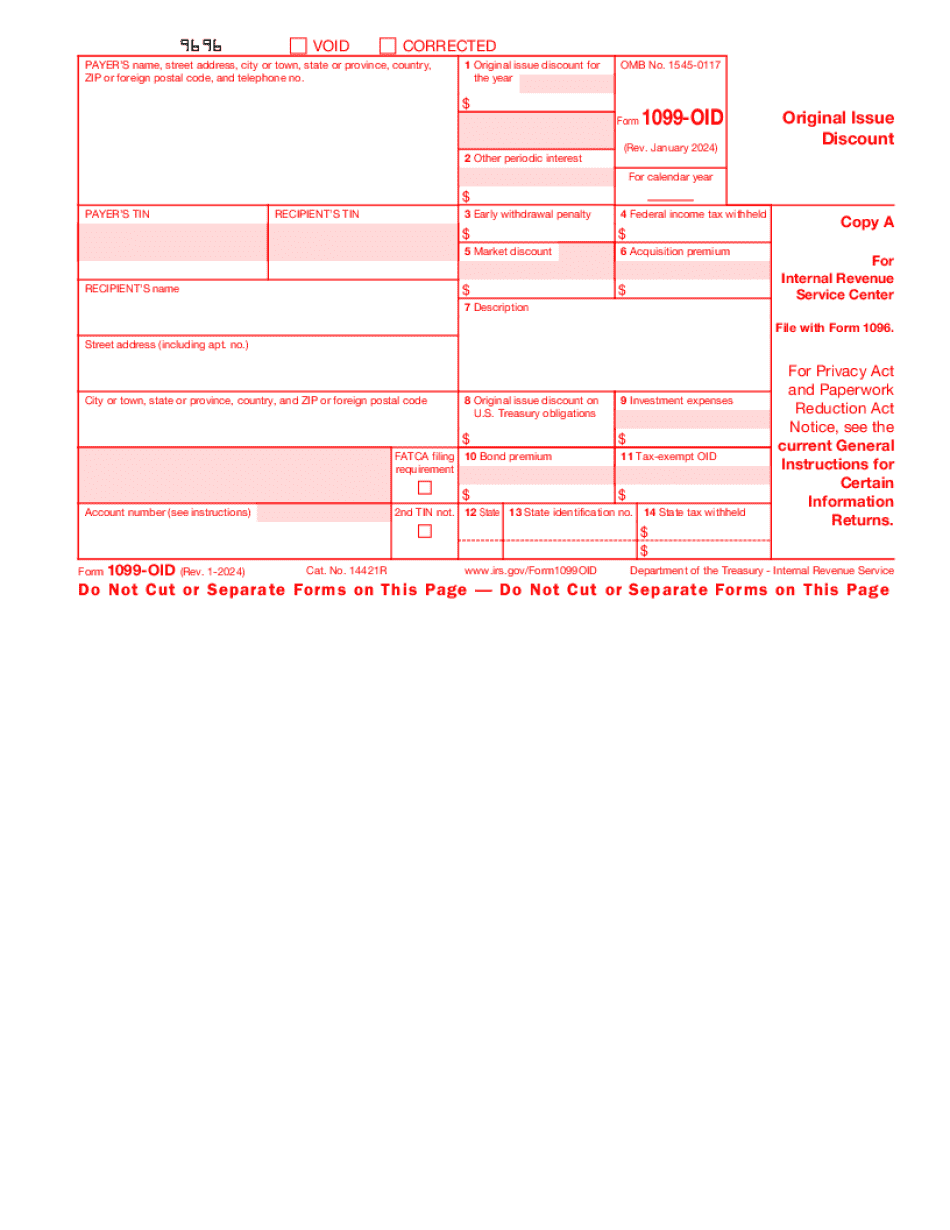

Form 1099-OID for Orange California: What You Should Know

The Tax Advisor is a more comprehensive form and will require more detailed writing of instructions. The Tax Advisor Form 1099-OID, Instructions for 1099-OID, and Instructions for 1099-OID is a more detailed form that will require more detailed reading of instructions. If you do not read the instructions carefully, this form can lead to mistakes. The most important thing is to ensure that the name and address in box 13, “Qualified Expenses of the taxpayer (excluding deductible expenses)” is the correct address for them to receive any Form 1099-OID sent to them. Do not change this address if the address you have listed is incorrect. Instructions for Form 1097-A (Employee Retirement Income Security Act), Employee Retirement Income Security Act, and Income Exemptions, Contributions, AND Interest 1099-INT is a basic form that is easily filled out as each item must be properly entered. The Tax Analyst Form 1096-B (Tax-Exempt Organization) and the Form 1096-OID, Instructions for the 1096-B, and Instructions for the 1096-OID are additional forms that have to be filled out. The Form 1096-B is also used to calculate the federal Earned Income Tax Credit (ETC) and the Additional Child Tax Credit (ACT) that are available through the IRS. The Tax Reporter is an additional form used to update your 1040, 1040A, 1040EZ, 1040AES, 1045, 1045EZ, 1040AES, and 1041 tax information. The Tax Reporter is also used to update any of the Form W-4s, 1099-MISC, 1099-MISC-EZ, and 923. The Tax Return Preparer (TRP) form was once part of the federal tax system, but as tax rates have been reduced over time, this form has become ineffective and is no longer used. Tax return preparation companies and tax law firms can still fill in the TRP form, but it will not result in any additional refunds. The Form 4868 Instructions for 1099-OID is an additional form that must be filled out if you are filing an ITIN (Individual Taxpayer Identification Number). The 4868 instructions are also used in cases where you are filing a Form 1040, 1040A, 1040EZ, or 1040AES.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-OID for Orange California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-OID for Orange California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-OID for Orange California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-OID for Orange California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.