Award-winning PDF software

CO online Form 1099-OID: What You Should Know

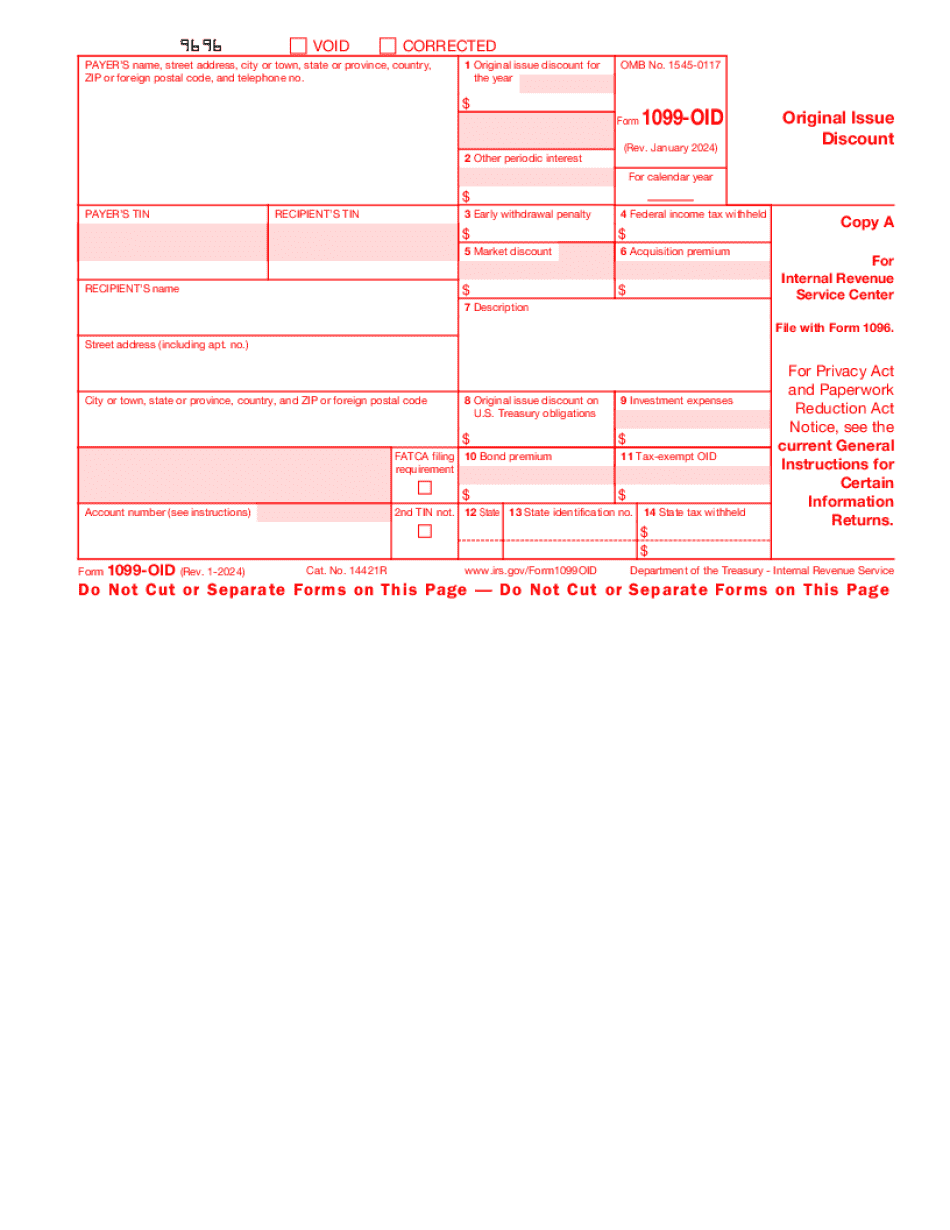

S. Source. Interest is usually reported in the Form 1099-J, Gross Profits Before Federal and State Taxes. (Not available for dividends). What does Form 1099-OID mean for Bond Interest or Interest Earned on Money Market Instruments? Interest on tax-exempt bonds that meet certain requirements is reported on Form 1033 and reported as Interest on Tax-Exempt Bond Interest, Interest on Tax-Exempt Money Market Securities, and Interest from Tax-Exempt Securities that meet certain requirements. Interest payments from tax-exempt bonds to fund the national debt are reported on Form 2345. Payments to the U.S. Treasury from tax-exempt securities are reported on Form 990-EZ. Payments to a foreign government are reported on Form 990 or 990-EZP. The net amount received from the bond is reported on Form 1040, Line 37. The total interest payment is reported on the Form 1099-N. Can bonds be used to pay the national debt? No. A national debt is a debt created to pay benefits of a state, county or local government, a state highway system, a county jail system, state school district, or any other public institution. The national debt of the United States is not a debt to pay for bonds to fund the national debt. It is a debt to pay for benefits and services that the government offers to the public. Is there a way to make Form 1099-OID available online? E-file 1099-OID online to file Forms 1099-OID for 2021. What is Form 1099-OID? — TurboT ax and Taxation The IRS issued its first form of the year, Form 1099-OID. In that day, it listed the annual valuation of the bond in brackets between 40,000 and 1 million. And it listed the yearly interest to be paid by the issuer. Form 1099-OID is designed for tax reporting purposes. If the bond is sold at least every 60 days, a Form 1099-OID is issued each reporting year. Form 1099-OID is available online at IRS.gov. It can be printed in advance and filed online or in a paper format and then mailed to the address listed on the form.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete CO online Form 1099-OID, keep away from glitches and furnish it inside a timely method:

How to complete a CO online Form 1099-OID?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your CO online Form 1099-OID aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your CO online Form 1099-OID from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.