Award-winning PDF software

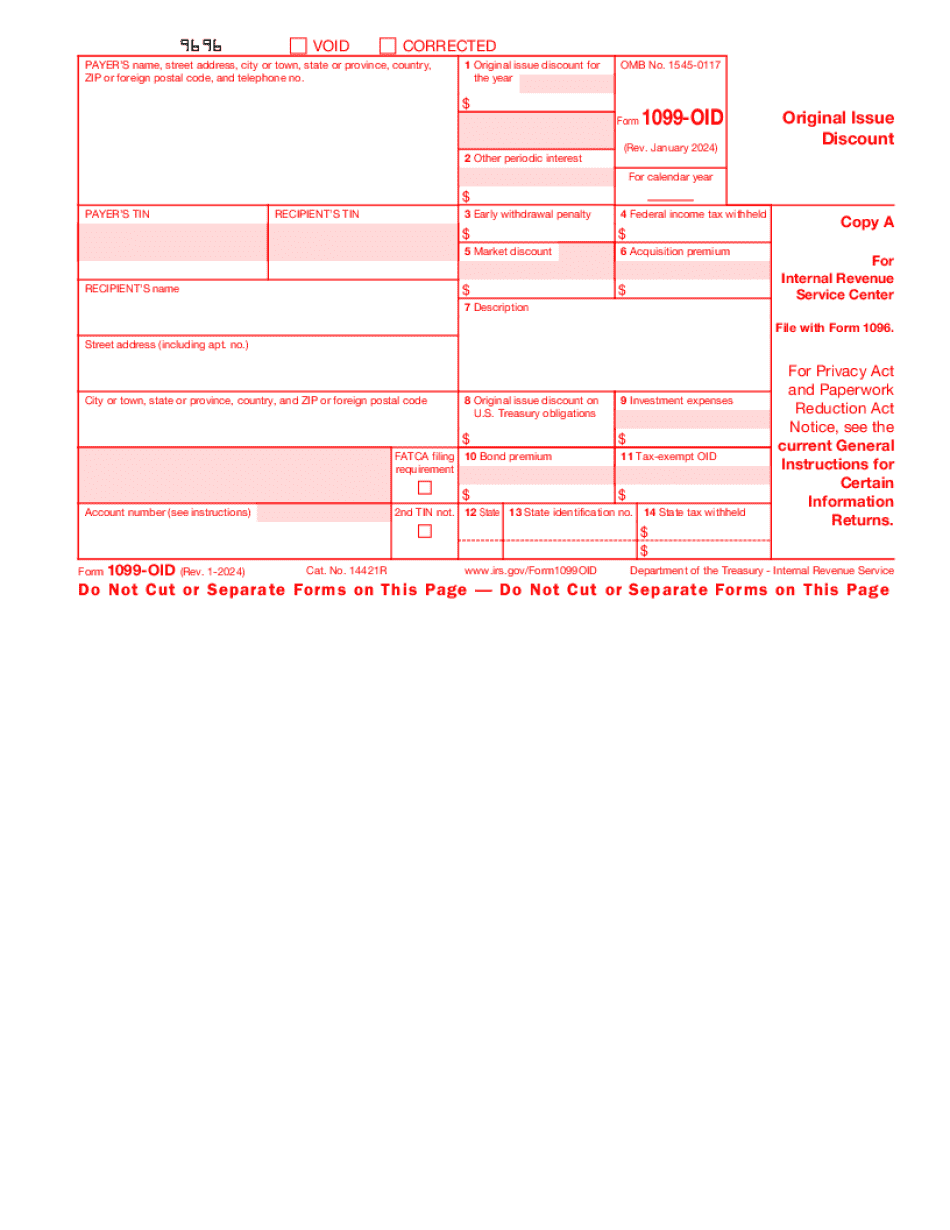

Form 1099-OID IN: What You Should Know

The original issue discount rule is used in some cases to determine capital loss carry forwards (in most situations, an original issue discount only needs to be reported for calendar years beginning in the calendar year in which the sale occurs). Form 1099-OID — Google Docs In this blog post about Form 1099-OID, H&R Block describes the IRS requirements in specific cases related to original issue discount. Original Issue Discount — IRS Original issue discount is the IRS form that you receive if the value of a property you bought or sold for less than its market value at the time of purchase or sale becomes not marketable. Original issue discount is similar to the original issue discount exclusion in IRC Section 1031(b)(5), with one important exception: The taxpayer does not have to have paid tax on a loss on disposition of the original issue discount property. In addition, for purposes of IRC Section 1431, the taxpayer does not have to have paid tax on the original issue discount property. See Regulations section 1.1431-3(b)(2) and (6). In situations where it is unclear whether the taxpayer has paid tax on a property, the taxpayer must include in income the proceeds received from a disposition of qualified property that the taxpayer knows or should know was originally issued at a price substantially less than its fair market value; see IRC Section 1431(b)(3). Revenues Received The following rules apply to determine whether you should record the original issue discount on Form 1040, 1040A, or 1040EZ: It is not necessary to record a capital Loss Carry back under IRC Section 1431. You may be required to include or exclude the proceeds received to the extent that you cannot reasonably estimate your tax liability for the proceeds with reasonable accuracy. The amounts included or excluded, will depend on the type of property you sold, the amount of the original issue discount, your adjusted gross income, if any, and so forth. If you are not a nominee, this should only be a reportable event for the previous year in which you paid income tax. If you were a nominee in the previous year, this should only be a reportable event for the previous year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-OID IN, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-OID IN?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-OID IN aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-OID IN from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.