Award-winning PDF software

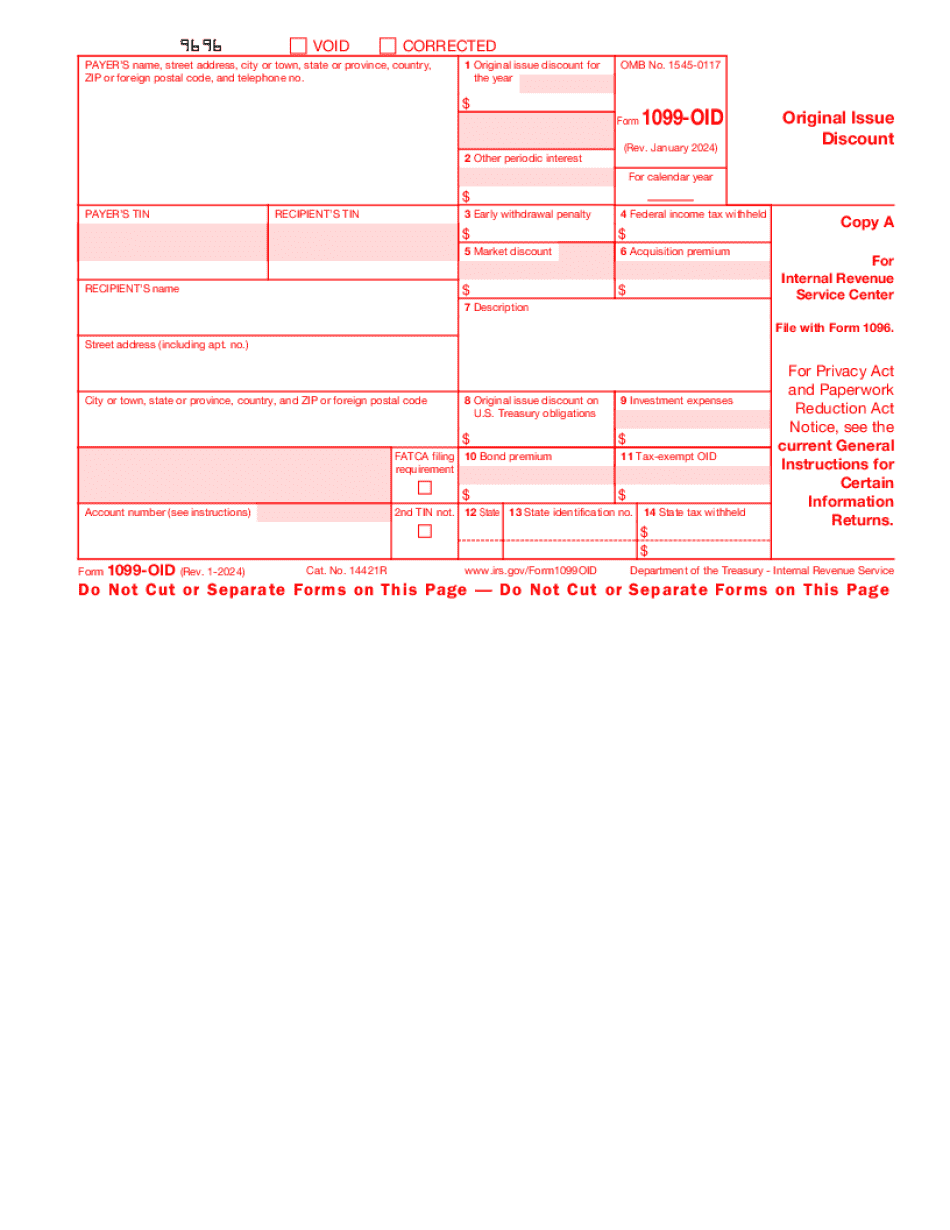

Los Angeles California Form 1099-OID: What You Should Know

Form 1099-G, Gambling Income) • Form 1099-IRA (Employer's Share of Income Taxes) • Form 1099-S Corporation Income • Form 1099-R Sole Proprietor Election • Form 1099-V Shareholder Election for a Partnership. ▻ Form 1099-K (Interest paid). If Form 1099-K is received, and it exceeds 400, it is taxable on the individual's gross income; 400 or less has no taxable impact. The 400 threshold can be reduced when all the following apply, if at all: • The individual is married; • The individual is filing an agreement (if the agreement is filed as a separate return); • The filing agreement contains a statement that the agreement is for an eligible interest payment only; • There is no agreement for any interest paid to a creditor at another address; and • The interest is paid in the United States and the individual is an individual or a person is not subject to tax in the United States with respect to the interest, the interest is paid to or for the benefit of a foreign entity, the interest is paid outside the United States, the interest is not exempt (for purposes of Part 1 of the Code) or the arrangement is not otherwise exempt (other than a Form K-1, Miscellaneous Income Agreement). ▻ Form W-2G (Interest income only) may be required with Form 1099-K if the individual's income from a trust, foundation, or corporation exceeds 600 per spouse or 400 for married individuals for a single filing. Deductions/Exemptions Form 1099 includes all expenses and allowances paid in connection with the sale, exchange, gift, gift receipt, transfer, distribution or other disposition of property and/or interest. A taxpayer who is a resident of another state will not report their total deduction but should consider whether their itemized deduction may exceed the amount reported on Form 1099 or Form 1098 Exemptions The itemized standard deduction is 6,350 if you are single; 12,700 if you are married filing a joint return; or 18,700 if you are married filing separately. An estate or trust subject to the Estate Tax may also exclude amounts from the standard deduction (see discussion of Estate Tax on IRS website).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Los Angeles California Form 1099-OID, keep away from glitches and furnish it inside a timely method:

How to complete a Los Angeles California Form 1099-OID?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Los Angeles California Form 1099-OID aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Los Angeles California Form 1099-OID from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.